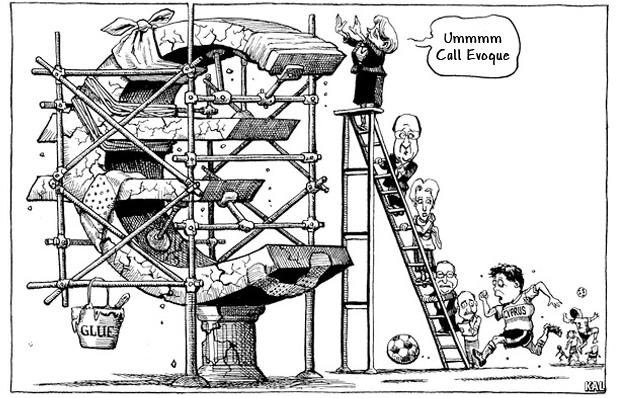

Prevent Your Investment Portfolio From Crumbling Like the Parthenon

Here’s the financial headline that greeted us in California not long ago: Markets take a pounding – Dow drops 280, now barely in the black for 2015.

But the interesting point to me was the reason behind the drop in stock prices. Once again Greece was tottering on the edge of default. This started me thinking about how events that none of us have any control over can dramatically impact our finances.

And it can happen overnight.

The best financial minds in Europe haven’t yet been able to figure out a way to fix the Greek financial situation and frankly I expect to wake up one morning to news that the country has defaulted and is leaving the Euro – but I’m not a global financial prognosticator, so don’t quote me on that. (By the way, this won’t hit our website immediately after I’m done writing it. By the time you’re reading this, the currency in Greece could again be its traditional drachma.)

Think locally, invest locally

However, with our expertise in California real estate at Evoque Lending, I do know the local markets and the locally based investment opportunities, especially First Trust Deeds. It’s been our experience that First Trust Deeds on Los Angeles real estate, Orange County real estate, and San Francisco area real estate perform extraordinarily well for local investors.

If you look at the history of California, you’ll discover that there has never been a shortage of people who want to live here and own property here. This has created a huge demand for investors willing to loan money toward the purchase of real estate.

The banks and big lending institutions aren’t the only ones who can tap into this demand. At Evoque Lending, we make it possible for investors like you and me to reap the rewards of investments backed by California real estate.

We are currently giving our investors a double-digit return on their money and allowing them the flexibility to set the term of the notes they fund. We know that maintaining control of your investment portfolio is important and we make sure that you’re always in the driver’s seat.

Safety comes first

Of course, safety is paramount and Evoque Lending uses two excellent “firewalls” to protect your money. First, we make sure that you are cushioned by some 40 percent of protective equity. Second, our experienced team thoroughly vets borrowers to make sure they have the ability to keep up with their monthly payments.

When you invest in Evoque Lending First Trust Deeds, you don’t have to worry about your investments getting wiped out by events that happen half way around the world in a country with an economy no bigger than the state of Missouri.

Further, you can make First Trust Deeds part of your retirement investment strategy. Given the general state of retirement accounts today, this can be a very smart move. Also, many retired individuals find that the regular monthly payments they receive via their First Trust Deed investments are a great way to maintain their disposable income at ideal levels.

Would you like to know how First Trust Deeds would best fit into your plans? Give me a call or simply drop me an email and I can answer your questions and give you important additional details.

I hope to hear from you soon and best of luck with all your investment choices.