Why It’s Not Always A Good Idea To Refinance... Unless You Know The Math

There’s a reason why banks are so profitable.

Quarter after quarter they show billions of dollars in profits. As most of us know, one major reason for this is banks pay depositors less than 1% return on their savings accounts and use those same monies to charge double digit rates on credit cards – some as high as 29.99%. Another major and often overlooked reason why banks are profitable is because they temp customers to refinance by selling them monthly savings and lower payments instead of teaching them the Math. They sell the sizzle. They make us think they are helping us and putting us in a better financial situation when in reality they are making themselves more profitable and hurting our pocket books. Let me explain further:

The average family (more than 90% of the population) refinances every three years. This occurrence is very high and triggered by either families needing cash and/or banks offering lower rates and benefits with billions of dollars in advertising. Where families end up hurting themselves is that they now take a loan they have paid three years of payments for, often with front-loaded interest, and reset this loan from the remaining 27 years, back to a new 30 year loan. Here’s a real life example:

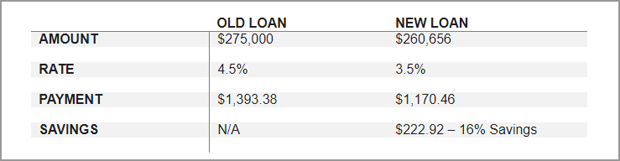

The table above shows a typical refinance which saves the client almost $223 per month which is 16% lower than their current payment. Please NOTE: I am using this scenario as if it was a free loan with zero costs to the client and also a rate and term refinance where no cash is being taken out. I have also used the loan amount of $260,656 because that is the balance of the original $275,000 loan after three years of payments. Here we see that after 36 payments of $1,393.39 per month which totals $50,161.68 in payments, the loan’s balance has only gone down $14,344 in principal balance meaning almost $36,000 was paid toward the interest of the loan in the past three years. Most clients would refinance if they had the above offer presented to them and throw away $36,000 of payments and interest to save themselves $223 per month.

Assuming they move ahead with the refinance to get the lower payment, can you tell me the ONE thing they need to do not to lose money?

How can we help you and your clients? Click Here.