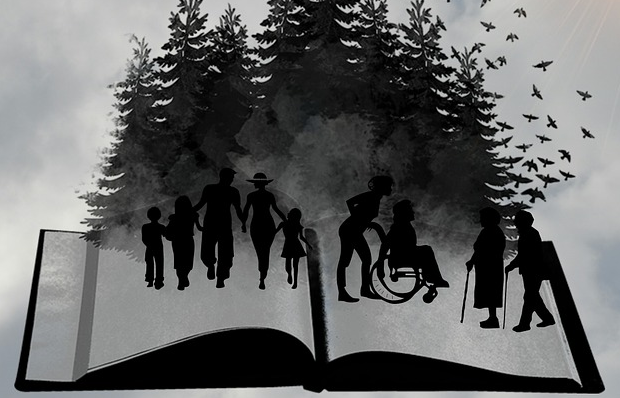

Investing at Each Stage of Your Life

I recently read an investment article that listed five life-changing events that will impact your finances. It was a good list. There were sound reasons behind every item on the list and I’ll share them with you here:

• Beginning a new career

• Marriage

• Starting a family

• Retirement

• Losing your spouse

Not to be too cynical, but perhaps the list would have been a little more complete if the author would have added a sixth item right after marriage: divorce. It’s not a topic we like to think about, but it certainly has a major financial impact on all parties.

Where are you today?

Can you find yourself on that list, or perhaps find the last “event” you experienced, or which one you think will occur next in your life? When you have a good idea where you stand along that informal timeline, I have one more question for you: Would a secure investment that delivers a double-digit yield work well with your financial plans?

When I scan that list of life events, I don’t see any where that kind of return wouldn’t be attractive today. And that’s why I encourage investors to take a look at 1st Trust Deeds. At Evoque Lending, our investors are enjoying returns today that usually come in above 10 percent.

I also suggest that as you scan the list and decide if a 10-plus percent return would work for you that you look at your upcoming life events. Consider how well a double- digit return today will prepare you for tomorrow. This is perhaps the most critical question you need to answer.

Always looking ahead

I’m confident that a secure and consistent return like that will contribute greatly to getting you positioned for your next stage in life. Sadly, a very high percentage of American’s today don’t or won’t have the funds they need to support their standard of living when they retire. Many have failed to invest at all. I urge you to not be included in that group. Make the investments and compile the savings you need to enter the next phase of your life on your terms.

Of course, investing your money safely should always be one of your primary objectives. At Evoque Lending, we assure safety in a variety of ways. First, we make sure that our investors get 40 percent protective equity. Second, we work with the best, most professional and experienced real estate appraisers to make sure the valuation is correct. Third, we carefully screen our loan applicants to make sure they have the ability to make their payments.

Flexible terms

Along with these measures to safeguard your investment, you can also tailor the terms of your loan to fit your current needs. For example, if you’re at the “beginning a new career” phase now, but you see marriage three years down the road, Evoque Lending could get you into a 1st Trust Deed that will cash out in time to meet any financial commitments that accompany your marriage.

I’ve presented a lot of information here in just a little space. Why not give us a call or send us an email so we can answer your questions and help you determine if investing in 1st Trust Deeds is right for you? We look forward to hearing from you.