Fighting The Law Of Averages

Averages are supposed to be rather dull and undramatic. After all, they’re just “average.” No one would put a bumper sticker on the family car that says, “My Son is an Average Student at George Washington Elementary School!”

But I have one average that will make your head spin like Linda Blair’s in “The Exorcist”: The average rent for a two-bedroom apartment in Los Angeles is $2,550.

Now, let’s set that average against another Los Angeles real estate average: The average home value in Los Angeles is $536,000.

Losing at the rent game

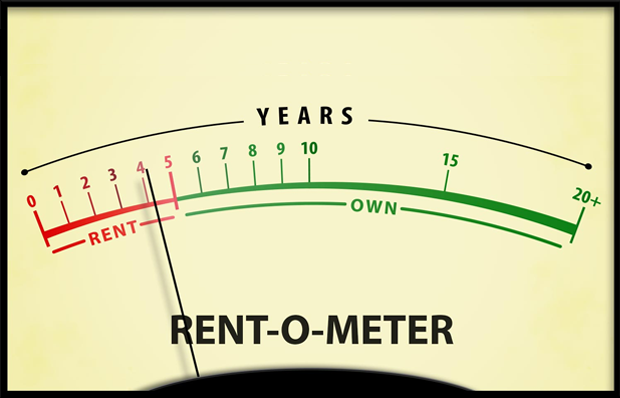

Here’s why I mention those two averages: The average rent in Los Angeles is higher than the monthly conventional loan house payment for the average home in Los Angeles. In other words, if you’re paying the average rent, you would save money each month if you were making payments on the average house. (Plus, you would have advantages that you don’t enjoy as a renter.)

I suspect this situation is true for real estate throughout California. If you’re in Orange County or anywhere in the San Francisco Bay Area I know rents are insanely high. I read about a Bay Area guy renting out a tent in his backyard for almost $1,000/month!

However, sometimes making the jump from renter – or backyard camper – to homeowner is difficult and frankly that’s probably one reason landlords are able to set their average rents at levels far higher than the average house payment. But if you can make the move from renter to owner, the benefits are huge.

At Evoque Lending we’ve found that the last recession hurt the credit scores of many local residents. They’ve been able to rebound financially since then, but their credit scores may not reflect that fact yet and their low credit score is what’s preventing them from joining the homeowner ranks.

Our solution to your problem

Evoque Lending has the solution to this problem. We’ve been helping buyers who have been turned down by conventional lenders and banks for more than 15 years. We don’t care about a credit score. We care about your ability to pay and the amount of equity you will have in your home.

While you can customize the term of your loan, we typically provide shorter term loans that let you get into your property and establish a financial history that let’s you move into a conventional loan at a later date. It’s the classic win-win situation; you get the property and soon you also get the loan that was originally declined.

As I said above, we’ve been working with people in your situation for many years. We know what you’re going through – the initial disappointment and frustration. You may have been making plans and suddenly bad news from a bank or conventional lender turned things upside down.

If you don’t take anything else from this short article, please take this: Don’t lose hope. I urge you to call me or drop me an email today to see if Evoque Lending can help out.

You have nothing to lose, not even your time. We have developed a system that allows us to give our clients answers within one day and even fund their loans in about a week.

Best of luck and I look forward to hearing from you!