The Top 3 Things Developers Fail to Anticipate That Could Cost Them Everything

There is no shortage of ambition among California’s commercial real estate developers. The opportunities are enormous, the returns can be transformative, and the market continues to attract capital from around the world. Yet even the most experienced developers have seen projects unravel because of a few critical oversights that only reveal themselves once shovels hit the ground.

Launching a multi-unit development in California is not for the faint of heart. Between regulatory complexity, financing hurdles, and unpredictable market cycles, success depends as much on anticipation as execution. Understanding where others stumble can mean the difference between a profitable build and a financial nightmare.

Here are three of the most common and costly missteps developers make when preparing to launch multi-unit projects in California, and how to avoid them.

1. Underestimating the True Impact of Entitlement and Local Regulations

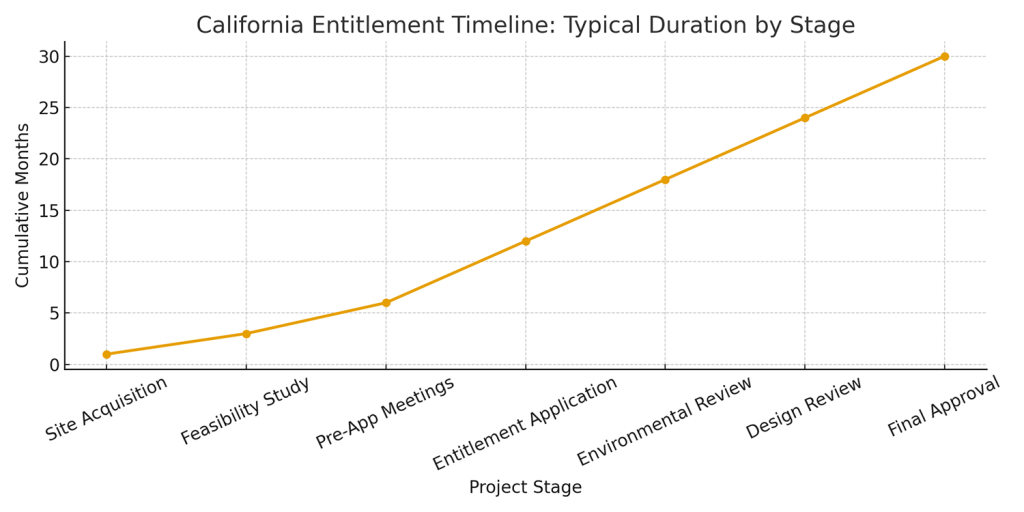

Every developer knows that entitlements are complicated in California, yet few fully appreciate how profoundly local regulations can affect a project’s timing, cost, and feasibility. The process can stretch for months or even years, and a single zoning nuance can derail an otherwise solid deal.

Cities and counties each maintain their own land use codes, building requirements, and review committees. What looks like a green light on paper can quickly become a maze of environmental impact reviews, public hearings, and conditional use permits. Delays in securing approvals can trigger financing issues, construction cost increases, and even contract penalties with investors or contractors.

Developers often underestimate not just the duration but also the sequencing of approvals. Missing a critical step early on, such as coordinating with the local planning department before submitting an application, can reset the clock entirely. Add in evolving legislation like SB 330, which restricts local governments from downzoning or limiting housing projects, and the regulatory landscape becomes even more fluid.

The Fix: Build extra time and capital into your entitlement timeline. Engage a local land-use attorney and a planning consultant before acquisition, not after. Early collaboration with municipalities can reveal potential objections long before they become expensive delays. Treat entitlement as a core phase of development rather than a prelude to it.

2. Misjudging Capital Stack Timing and Liquidity Requirements

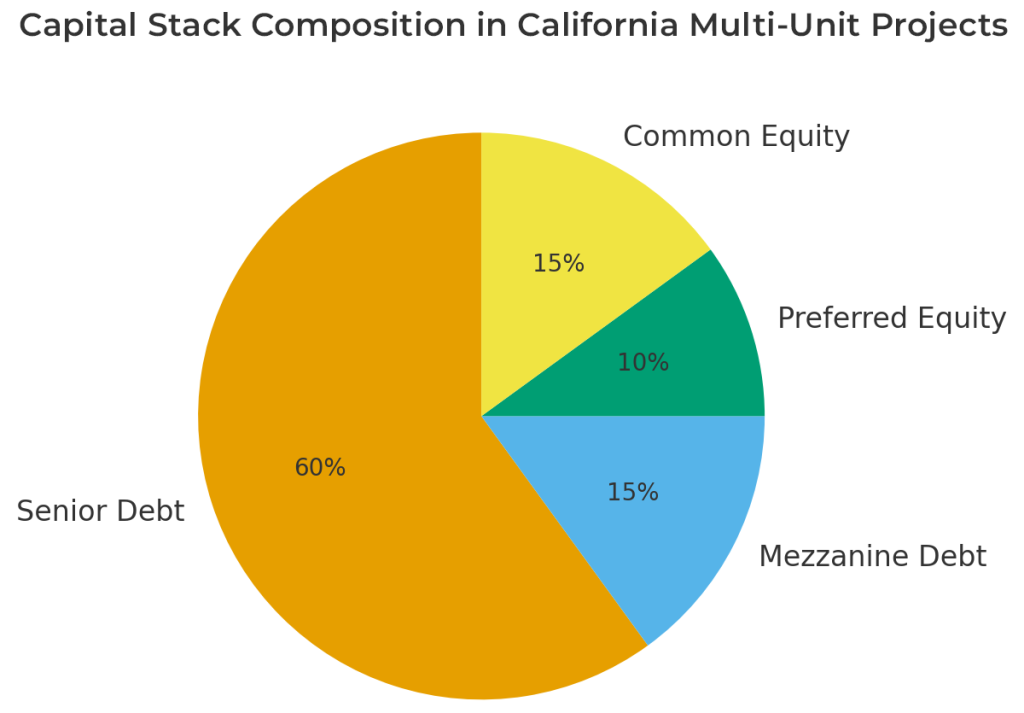

In a market as expensive as California’s, developers walk a fine line between opportunity and overexposure. One of the most common mistakes is assuming that project financing will fall neatly into place once entitlements are secured. The reality is more complex.

Rising construction costs, lender tightening, and fluctuating interest rates have changed the game. Traditional banks have become more selective, often requiring pre-leasing thresholds or additional equity participation. At the same time, private capital and debt funds are stepping in, but not without higher costs and shorter terms.

Developers sometimes structure their capital stack based on optimistic timelines, assuming that construction loans will close within a predictable window. When entitlement delays or value-engineering changes push schedules out, those financing assumptions can collapse. Carrying costs mount, partners grow anxious, and liquidity dries up at the exact moment it is most needed.

The Fix: Design your capital structure to absorb disruption. Build in contingencies for both cost overruns and timing delays. Develop relationships with multiple lenders, including private debt and bridge capital sources, well before you need them. The developers who thrive in California’s environment are those who maintain liquidity flexibility and never rely on a single financing path.

3. Failing to Anticipate Market Shifts and Absorption Realities

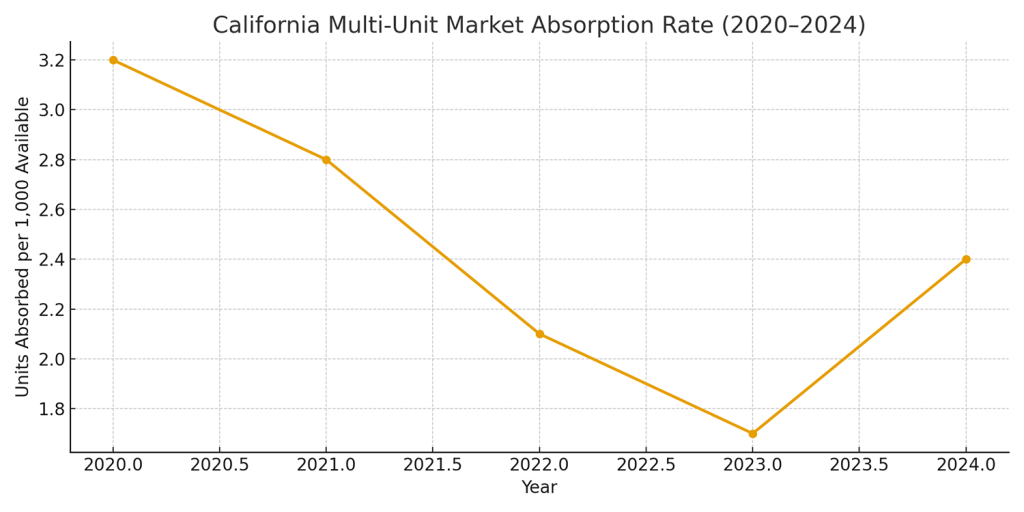

Many multi-unit projects that looked brilliant on paper end up missing their mark because developers assumed yesterday’s demand patterns would hold tomorrow. California’s markets evolve fast. Demographics, work patterns, and tenant expectations shift almost overnight.

For example, projects designed around pre-pandemic assumptions about office adjacency or commuter corridors may now find themselves competing in a hybrid-work world where tenants prioritize walkability, amenities, and flexible layouts. Similarly, developers who price units based on peak-year comparables can end up chasing an absorption curve that never materializes.

Even within the same city, submarket dynamics vary dramatically. A project in Culver City faces an entirely different demand profile than one in downtown Los Angeles. Developers who fail to study micro-market data, including absorption rates, new supply pipelines, and demographic inflows, often discover too late that their pro forma was built on wishful thinking.

The Fix: Rely on current, hyperlocal data rather than statewide trends or last year’s comps. Commission independent market studies that account for shifts in employment, migration, and tenant preferences. Keep your unit mix flexible, and resist the temptation to overdesign for a single demographic. Projects that can pivot, either by adjusting layouts, pricing, or amenities, stand a far better chance of weathering unexpected shifts.

The Ripple Effect of Small Miscalculations

What makes these three pitfalls so dangerous is that they rarely appear catastrophic at first. A few extra months in entitlement, a slightly higher construction budget, or a slower leasing pace might seem manageable. But compounded together, these small missteps can drain liquidity, strain partnerships, and trigger cascading effects that jeopardize the entire development.

The developers who succeed in California are those who plan not just for what they expect, but for what they cannot predict. They approach every project with humility toward the process, precision in their financial modeling, and a deep respect for how quickly the ground can shift beneath their feet, figuratively and literally.

A Final Word on Foresight

Launching a multi-unit development in California is as much about endurance as it is about vision. The margins are thinner, the regulations tougher, and the stakes higher than almost anywhere else in the country. Yet for those who anticipate the hurdles before they appear, the rewards remain unmatched.

The key lies in preparation. Understand the nuances of your entitlement pathway. Build a capital stack that can withstand turbulence. And never lose sight of the market forces shaping demand in real time.

When those three elements align – regulatory awareness, financial flexibility, and market intelligence – California becomes less of a battleground and more of an opportunity landscape. The developers who master anticipation will be the ones still standing when the next cycle turns, not scrambling to recover what might have been.