Unlocking Opportunity: Turning Luxury Real Estate Into High-Yield Multi-Unit Income

Across key markets, high-end residential properties are beginning to evolve. Not in their architectural style or square footage, but in the way they generate value. More and more seasoned investors and luxury homeowners are rethinking what it means to own a $5 million-plus residence, especially when the landscape of housing demand is shifting rapidly.

While the traditional approach to luxury real estate often involved holding a single-family home as a legacy asset, today’s most forward-thinking investors are opting to convert these properties into multi-unit rentals or co-living spaces. This strategy is proving to be a powerful way to tap into a property’s full potential, create steady income, and stay aligned with market demand.

Understanding the Shift in Housing Demand

High-net-worth individuals are usually among the first to recognize and act on macro trends. Right now, the housing market is facing unprecedented pressure from both affordability challenges and lifestyle changes. Urban professionals, digital nomads, and even downsizing retirees are increasingly seeking flexible, community-oriented living arrangements. This demand has fueled a growing appetite for multi-unit dwellings and co-living concepts that offer privacy, shared amenities, and convenience – all without the commitment of a traditional long-term lease or the overhead of ownership.

Luxury neighborhoods, once designed exclusively for large single-family estates, are becoming ripe for reimagination. A thoughtfully designed conversion that maintains the integrity of a home’s architecture while introducing multiple self-contained living units or a curated co-living experience can transform a static asset into a dynamic revenue-generating property.

Why Now Is the Time to Tap Equity

Tapping into home or commercial property equity has become a powerful financial tool for individuals and investors looking to unlock new opportunities. Whether it’s through a cash-out refinance, reverse mortgage, or private loan, people are putting their equity to work in creative and strategic ways.

For luxury homeowners, this means capitalizing on the dormant value of a property that may have appreciated significantly over the years. Instead of letting that equity sit idle, many are drawing on it to fund renovations or conversions that open up a new stream of cash flow. In prime zip codes where rental demand remains strong, the returns can far outweigh traditional appreciation strategies.

The Advantage of the Existing Footprint

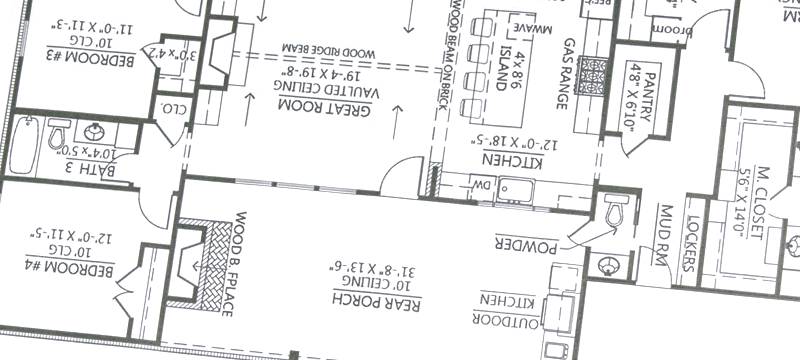

One of the biggest advantages of converting a luxury single-family home into a multi-unit setup is that much of the value already exists. The land is secured. The structure is in place. In many cases, the square footage offers more than enough room to design independent suites, shared kitchens, luxury common spaces, or even detached guest quarters.

This approach not only minimizes the upfront cost compared to ground-up development, but it also streamlines permitting and zoning processes in municipalities where adding new multifamily housing might otherwise face pushback. Some localities are even encouraging such adaptive reuse as a way to meet housing targets without sacrificing character or charm.

Diversification Without Liquidation

Real estate is often a cornerstone of long-term wealth strategy. But traditional ownership models offer limited flexibility. By converting a luxury property into a multi-unit income-producing asset, homeowners can diversify their investment portfolio without needing to sell or downsize. For those looking to retire in place, support extended family, or simply make smarter use of their real estate, this option provides control, flexibility, and a dependable return.

In some cases, a portion of the converted property can still be used as a primary residence while the rest is leased to vetted tenants. This blended approach allows homeowners to retain the comfort and prestige of their home while offsetting expenses and building passive income.

Financing the Vision

Accessing the capital needed for a conversion does not have to be complicated. For many, the answer lies in the equity they have already built. Whether through a private lending solution, a streamlined refinance, or a nontraditional product tailored for high-value real estate, funding is available without the red tape of conventional bank financing.

Private lenders, in particular, understand the unique value of luxury real estate and are often able to move quickly. Their flexibility can make all the difference when timing is critical, especially in competitive markets where delays can cost more than just convenience—they can cost opportunity.

Final Thoughts

The idea of converting a luxury home into a multi-unit property or co-living space is not about letting go of prestige or privacy. It is about evolving with the times and seeing value where others see limitations. It’s about treating real estate not just as a place to live, but as a vehicle for growth, income, and lasting impact.

For the investor with vision and the homeowner with equity, there has rarely been a better moment to explore what conversion could look like. The demand is there. The financing is accessible. And the benefits, from increased revenue to greater financial resilience, are well within reach.Your property has potential beyond its square footage. The next move is yours.